Financial Liberalisation and Stock Markets Integration: Further Evidence from Nigeria, South Africa and Egypt

Keywords:

integration, stock market, financial liberalizationAbstract

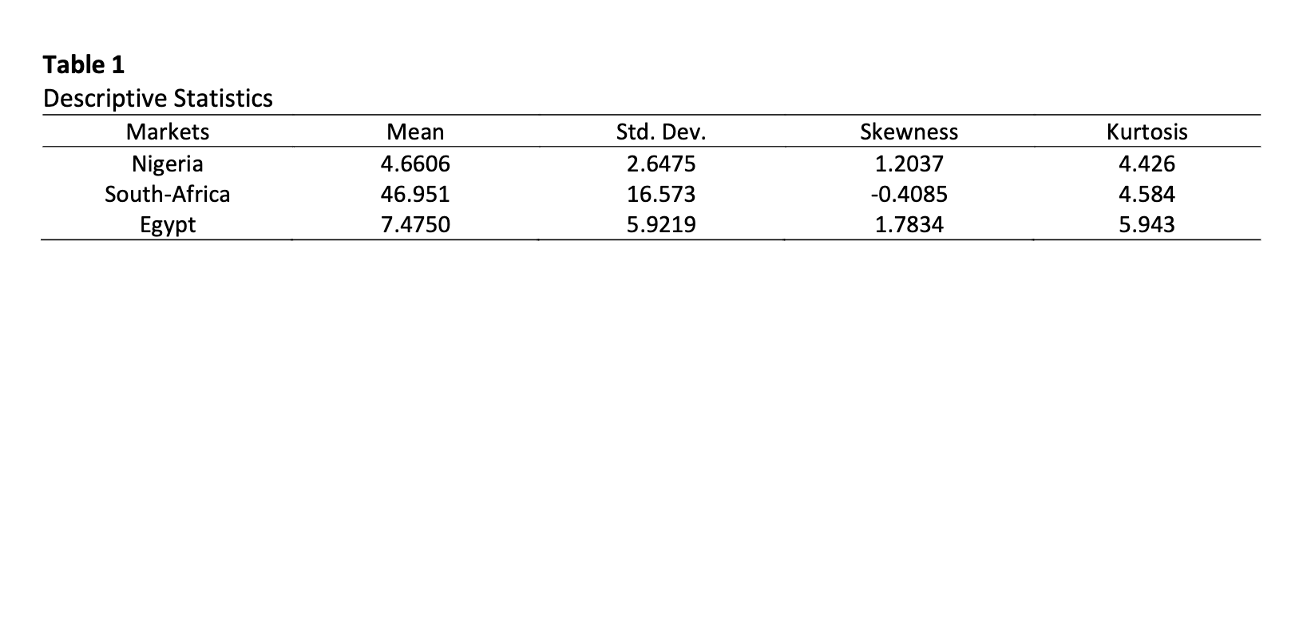

The aim of this paper is to analyse the financial liberalisation and stock markets integration of Nigeria, South-Africa and Egypt. The study is conducted for the period of 1989-2016 and comprised both the pre- and post-liberalisation era. The paper employed the Vector Autoregressive methodology. The use of the financial liberalisation dummy gives a better insight into the impact of financial liberalization on the integration of markets. The result showed there is no long-run relationship between the selected stock exchange markets. The result further showed evidence of short-run dynamics between stock exchange markets. The generalized impulse response functions showed that all the markets responded from shock. The financial liberalization dummy is positive and significant and implied its impact on the integration of the markets. The paper concluded that the stock markets are not fully integrated. As such, investors who have long-term investment plans can diversify their portfolios across the three selected stock markets.