Classify Stock Market Movement Based on Technical Analysis Indicators Using Logistic Regression

Keywords:

technical analysis, logistic regression, classification, stock marketAbstract

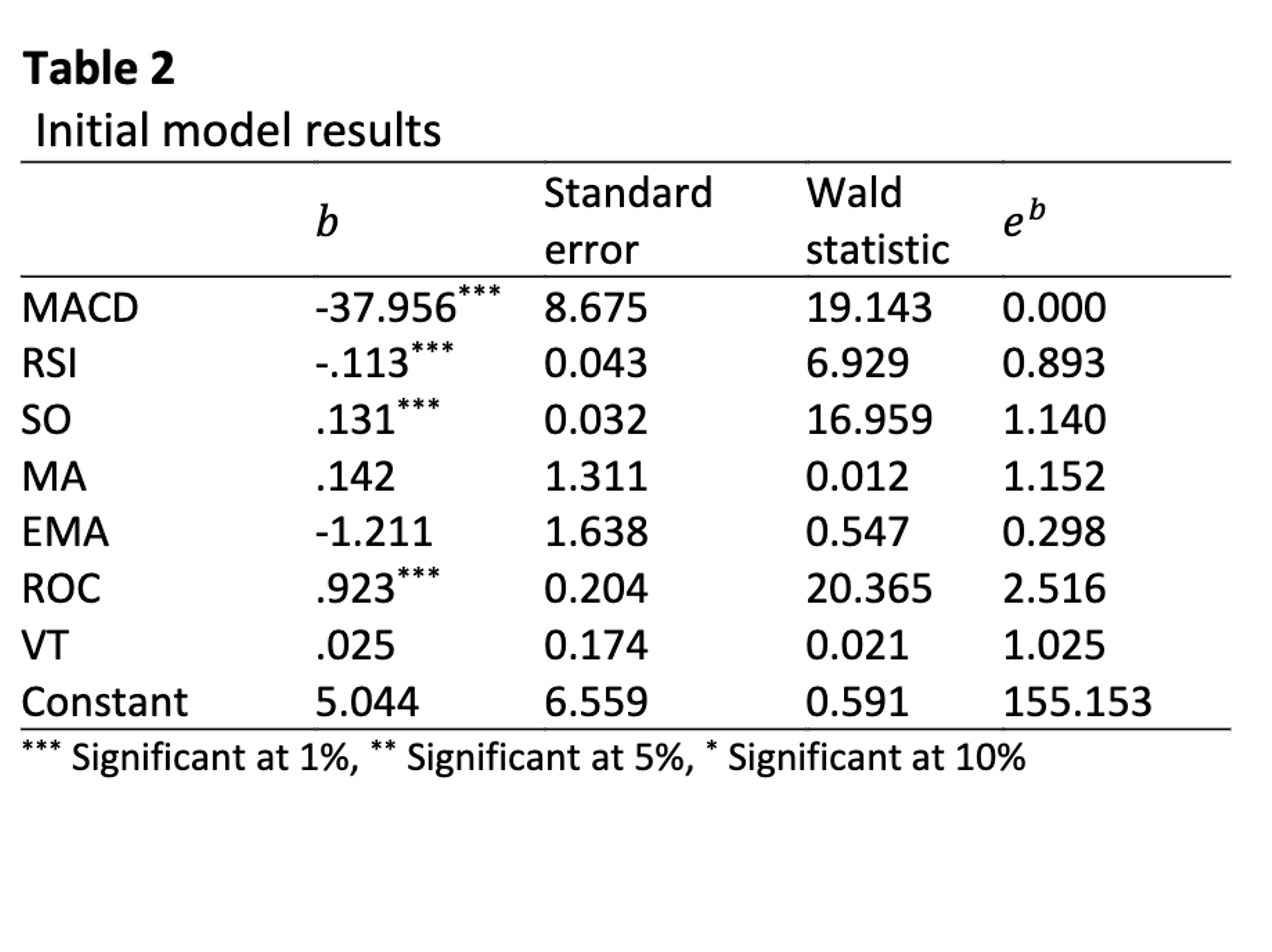

Stock market has been the centre of attraction for investors for a long period of time. The investor’s goal is to buy the stock, hold it for a period, and then, sell the stock for more investor paid for it. Many people invest to create wealth and to gain a rich reward. By investing in the stock market, it will improve the returns equity. In this study, the main focus is to predict the future stock price movement for one company listed in Bursa Malaysia. This study used eight months daily basis of historical data to model the relationship using logistic regression. By using logistic regression, stock market movement able to predict the stock price movement, either an increasing trend or unchanged or decreasing movement. Seven technical indicators were used as predictor variables in model formulation, which were Moving Average, Exponential Moving Average, Relative Strength Index, Moving Average Convergence Divergence, Rate of Change, Stochastic Oscillator, and Volume Trading. The results shown that the percentage of correctly classified stock market movement is 86% using in-sample validation data and 71.43% in out-of-sample data. At the end of the model logistic regression formulation, four significant technical indicators to predict the price movement of stock market movement were identified.