Hubungan antara Tadbir Urus Korporat dan Penyataan Semula Penyata Kewangan di Malaysia

The relationship between Corporate Governance and Restatement of Financial Statements in Malaysia

Keywords:

tadbir urus korporat, jawatankuasa audit, pemilikan, Malaysia, penyataan semula kewangan, financial restatement, corporate governance, audit committee, ownershipAbstract

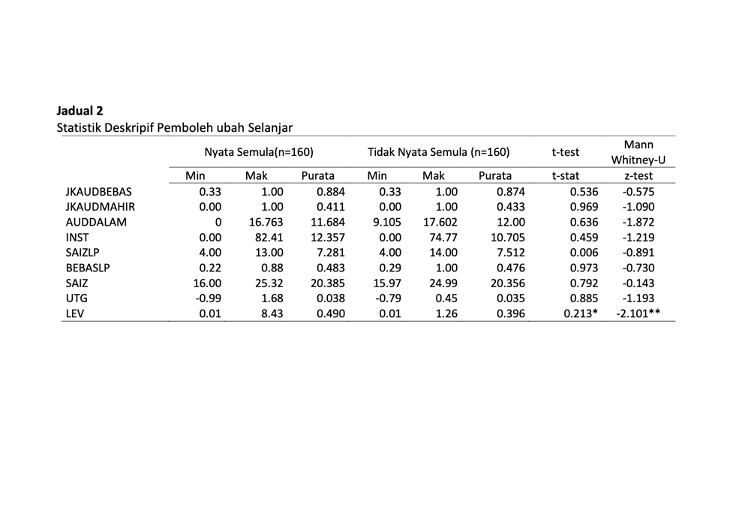

Kajian ini memeriksa hubungan di antara amalan tadbir urus korporat dengan kejadian penyataan semula penyata kewangan dalam kalangan syarikat tersenarai di Bursa Malaysia untuk tempoh dari tahun 2013 hingga 2015. Populasi data adalah semua syarikat yang tersenarai kecuali syarikat kewangan. Kajian ini mendapati sebanyak 160 syarikat telah menyatakan semula penyata kewangan dalam tempoh tersebut. Kumpulan kawalan yang terdiri daripada syarikat yang tidak menyatakan semula penyata kewangan dipilih berdasarkan sektor industri dan saiz syarikat. Seterusnya regresi logistik digunakan bagi menganalisi data. Keputusan kajian menunjukkan kualiti audit dalaman, juruaudit Firma Big 4 dan pemilikan institusi mempengaruhi kejadian penyataan semula penyata kewangan. Kajian ini mendapati kualiti audit dalaman dapat mengurangkan kemungkinan berlaku penyataan semula penyata kewangan. Sebaliknya syarikat yang diaudit oleh juruaudit Firma Big 4 lebih berkemungkinan berlaku penyataan semula penyata kewangan. Dapatan kajian ini juga mendapati wujud hubungan positif dan signifikan di antara pemilikan institusi dan penyataan semula penyata kewangan. Manakala amalan tadbir urus korporat yang lain iaitu jawatankuasa audit, juruaudit kepakaran industri dan pemilikan keluarga didapati tidak mempengaruhi kejadian penyataan semula penyata kewangan. Disamping itu syarikat yang memiliki leveraj yang tinggi didapati lebih berkemungkinan terlibat dengan penyataan semula penyata kewangan.

This study examines the relationship between corporate governance practices and the restatement of financial statements among listed companies in Bursa Malaysia for the period from 2013 to 2015. The population is all listed companies except finance companies. This study finds that 160 companies have restated their financial statements during the period. The control group comprising companies that do not restated financial statements are selected based on the industry sector and size of the company. The logistic regression is further used to analyze the data. The results of the study show that internal audit quality, Big 4 auditors and institutional ownership have influenced the occurrence of restatement of financial statements. This research also finds that the quality of internal audit can reduce the likelihood of restatement of the financial statements. Conversely, companies audited by Big 4 auditor are more likely to have a restatement of the financial statements. The findings also show a significant relationship between institutional ownership and restatement of financial statements. While other corporate governance practices, ie the audit committee, the auditor of industry expertise and the family ownership do not have a relationship with the restatement of financial statement. In addition, companies with high leverage are more likely to be involved with the restatement of the financial statements.