Pre and Post-Merger and Acquisition Performance of Companies in the Malaysian Energy Sector

Keywords:

Merger and acquisition, M&A, company performanceAbstract

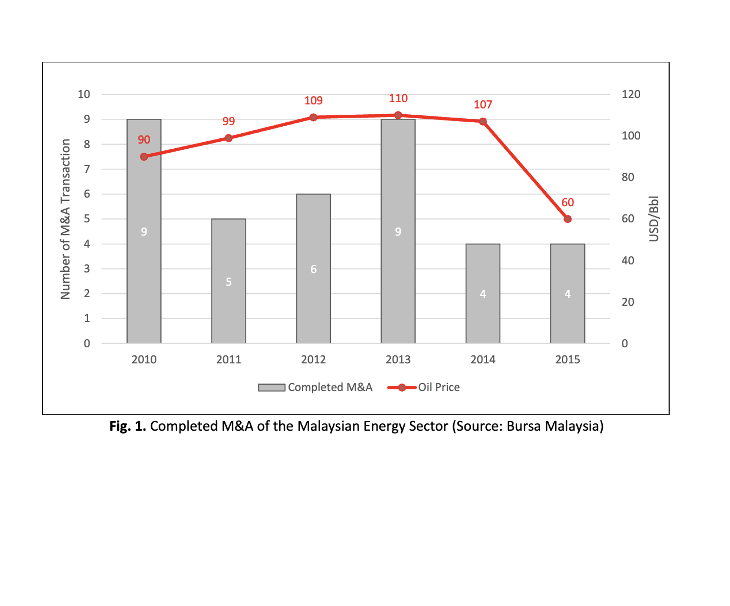

The Malaysian energy sector companies are experiencing a high competition market in a fast-changing global market. They require synergy, which aligns with one of the critical Mergers and acquisitions (M&A) motives to acquire market strength or penetrate the new market to bid for significant oil and gas (O&G) projects. This study aims to analyze the M&A performance of Malaysian energy sector companies. The study is important because it represents a critical shift in every business strategy. The consolidation needs to be well prepared and conducted systematically to achieve a good result. This study will shed light on the impact of mergers and acquisitions on financial performance for investors and firms in Bursa Malaysia. Company annual financial reports data were gathered for the periods of pre-and post-M&A. The ratio analysis was conducted using financial ratios related to liquidity, profitability, leverage, and efficiency to evaluate company performance. The finding shows insignificant improvement in liquidity, profitability, leverage, and efficiency after the M&A period. This research implication confirms the findings of previous studies that companies have not had a stronger financial performance after M&A and that M&A was unsuccessful in creating synergy with the effective use of resources on a long-term basis.