Revenue/Cost Production sharing Contract (PSC) Fiscal Regime on Marginal Gas Fields in Malaysia: Case Study

DOI:

https://doi.org/10.37934/progee.26.1.1118Keywords:

Marginal field, Revenue/Cost (R/C), Production Sharing Contract (PSC)Abstract

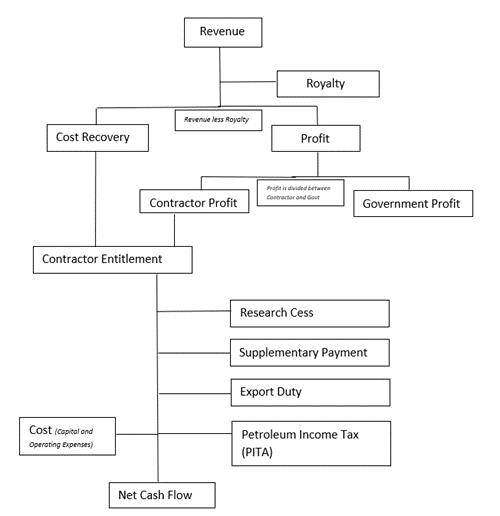

Despite the increasing global demand for natural gas, there are many marginal oil and gas fields that lie idle and are not developed mainly due to the uneconomic feasibility of the project. One of the main factors hindering the monetization of these small fields is the unfavourable fiscal conditions. This is the main reason why many potential marginal fields that do not meet the economic criteria required for commercial development are stranded. Thus, this paper aims at assessing the existing Revenue/Cost (R/C) Production Sharing Contract (PSC) fiscal regime on marginal gas fields in Malaysia via sensitivity and scenario analysis studies. It is found that reduction in cost of capital, tax rate or other PSC payments parameters helps to improve the NPV however the analysis shows the R/C tranches consists of cost recovery limit, excess cost recovery and profit-sharing percentage are the significant factors driving the cash flow.

References

O.O. Iledare, Upstream petroleum economic analysis: Balancing geologic prospectively with progressive, stable fiscal terms and instruments, 2014. https://jpt.spe.org/twa/upstream-petroleum-economic-analysis-balancing-geologic-prospectivity-progressive-stable-fiscal-term (accessed September 25, 2023).

L. Dongkun, Y. Na, Assessment of fiscal of international petroleum contracts, Petroleum Exploration and Development 37(6) (2010) 756–765. https://doi.org/10.1016/S1876-3804(11)60009-8.

D. Karasalihovic, G. Barbir, V. Brkic, Types of fiscal regime in hydrocarbon exploration and production, The Mining Geology Petroleum Engineering Bulletin (2017) 45–54. https://doi.org/10.17794/rgn.2017.1.6.

E.T.H. Lee, Scope For Improvement: Malaysia's Oil And Gas Sector, 2013. https://refsa.org/wp-content/uploads/2020/10/pdfslide.net_og-scoping-report-malaysia-final-20130701-compressed.pdf (accessed September 25, 2023).

D. Johnston, International exploration economics, risk, and contract analysis, Pennwell Books, Dallas, TX, 2003.

I. Agalliu, Comparative assessment of the federal oil and gas fiscal systems, US Department of the Interior, Bureau of Ocean Energy Management Herndon. VA. Cambridge, Massachusetts, 2011. https://www.boem.gov/sites/default/files/oil-and-gas-energy-program/Energy-Economics/Fair-Market-Value/CERA-Final-Report-November-2011.pdf.

H. Perera, M.I. Zaharudin, ZEEPod Reshaping the Future of Oil & Gas Marginal Field Development in Malaysia, in: ICCOEE2020 Proceedings of the 6th International Conference on Civil, Offshore and Environmental Engineering, 2021: pp. 221–231. https://doi.org/10.1007/978-981-33-6311-3_26.

P.V. Meurs. Government Take and Petroleum Fiscal Regimes, 2008. www.petrocash.com (accessed September 25, 2023).

Energy Commission. Malaysia Energy Statistics Handbook, 2018. https://meih.st.gov.my/documents/10620/c7e69704-6f80-40ae-a764-ad0acf4a844d.

Business Monitor International Ltd. Malaysia Oil and Gas Report Q1 2016, BMI Research, Business Monitor International Ltd, London, United Kingdom, 2015. https://community.ump.edu.my/ecommstaff/sites/default/library/subfolders/12780/1/BMI_Malaysia_Oil__26_Gas_Report_Q12016.pdf.

N.A. Babjide, C.A. Ogunlade, D.O. Areme, S.T. Oladimeji, O.A. Akinyele, Comparative Analysis of Upstream Fiscal Systems of Three 93) Petroleum Exporting Countries: Indonesia, Nigeria and Malaysia. International Journal of Science: Basic and Applied Research 15(2) (2014) 99–115. https://www.gssrr.org/index.php/JournalOfBasicAndApplied/article/view/2657.

D. Johnston, Changing fiscal landscape, The Journal of World Energy Law & Business 1 (2008) 31–54. https://doi.org/10.1093/JWELB/JWN006.

A.A. Faizli, Is Malaysia’s Rigid Fiscal Regime the Best Recipe for Petronas’ Success?, 2012. https://aafaizli.com/is-malaysias-rigid-fiscal-regime-the-best-recipe-for-petronas-success/

Petronas Annual Report PE, 2011. https://www.petronas.com/media/reports/annual-report-2011 (accessed September 25, 2023).

Exploration opportunities in Malaysia, Appex, London, 2016. https://www.internationalpavilion.com/APPEX%20Talks%202016/APPEX%202016%20Petronas.pdf (accessed September 25, 2023).

M. Gerber, Delivering strategy, performance and growth, RocOil Company Overview, 2012. https://www.rocoil.com.au/Media-Centre/News-Release/Latest-Newsd41d.html?translation-code=0 (accessed September 25, 2023).

R.D. Putrohari, PSC term and condition and its implementation in South East Asia region, in: Proc. Indon Petrol. Assoc., 31st Ann. Conv., Indonesian Petroleum Association (IPA), Jakarta, n.d. https://doi.org/10.29118/IPA.617.07.BC.127.

I.J.O. Akhigbe, How Attractive is the Nigerian Fiscal Regime, Which is Intended to Promote Investment in Marginal Field Development? CAR CEPMLP Annual Review, (2007) 10. https://www.dundee.ac.uk/corporate-information/cepmlp-annual-review-car.

A.O. Ogunlade, How can Government Best Achieve its Objectives for Petroleum Development: Taxation and Regulation or State Participation?, SSRN Electronic Journal (2010). https://doi.org/10.2139/ssrn.1658192.

R. Artist, Optimizing Mining Taxation for the Mineral Industry in Suriname: A Case Study of the Bauxite Mining Sector, MBA, Maastricht School of Management (MSM), The Netherlands, 2009. https://www.yumpu.com/en/document/read/31582164/optimizing-mining-taxation-for-the-mineral-industry-in-suriname-a- (accessed October 17, 2023).

S. Tung, S. Cho, The impact of tax incentives on foreign direct investment in China. Journal of International Accounting, Auditing and Taxation, 9(2) (2000) 105–135. https://doi.org/10.1016/S1061-9518(00)00028-8.

J. Morisset, N. Pirnia, How tax policy and incentives affect foreign direct investment: A review, The World Bank, 1999. https://doi.org/10.1596/1813-9450-2509.

H. Abdo, The taxation of UK oil and gas production: Why the windfalls got away, Energy Policy 38 (2010) 5625–5635. https://doi.org/10.1016/j.enpol.2010.05.010.

A. Kemp, L. Stephen, The effects of Budget 2011 on Activity in the UK Continental Shelf, Aberdeen Centre for Research in Energy Economics and Finance, North Sea Study Occasional (2011a) Paper No. 120. https://www.abdn.ac.uk/business/documents/nsp-120.pdf (accessed September 25, 2023).

T.H. Moran, Multinational Corporations and the Politics of Dependence, Princeton University Press, 1983. https://doi.org/10.1515/9781400854424.

J. Nebus, C. Rufin, Extending the bargaining power model: Explaining bargaining outcomes among nations, MNEs, and NGOs, Journal of International Business Studies 41 (2010) 996–1015. https://doi.org/10.1057/jibs.2009.43.

P.R. Rose, Risk Analysis and Management of Petroleum Exploration Ventures, American Association of Petroleum Geologists, 2001. https://doi.org/10.1306/Mth12792.

Brent Crude Oil Prices. https://www.macrotrends.net/1369/crude-oil-price-history-chart (accessed September 25, 2023).

Henry Hub Natural Gas Spot Price. https://www.macrotrends.net/2478/natural-gas-prices-historical-chart (accessed September 25, 2023).

C. Nakhle, Petroleum Taxation, Routledge, 2008. https://doi.org/10.4324/9780203927892.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Progress in Energy and Environment

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.